Asia’s New Influencer Economy is Built on Transparency, Not Trends

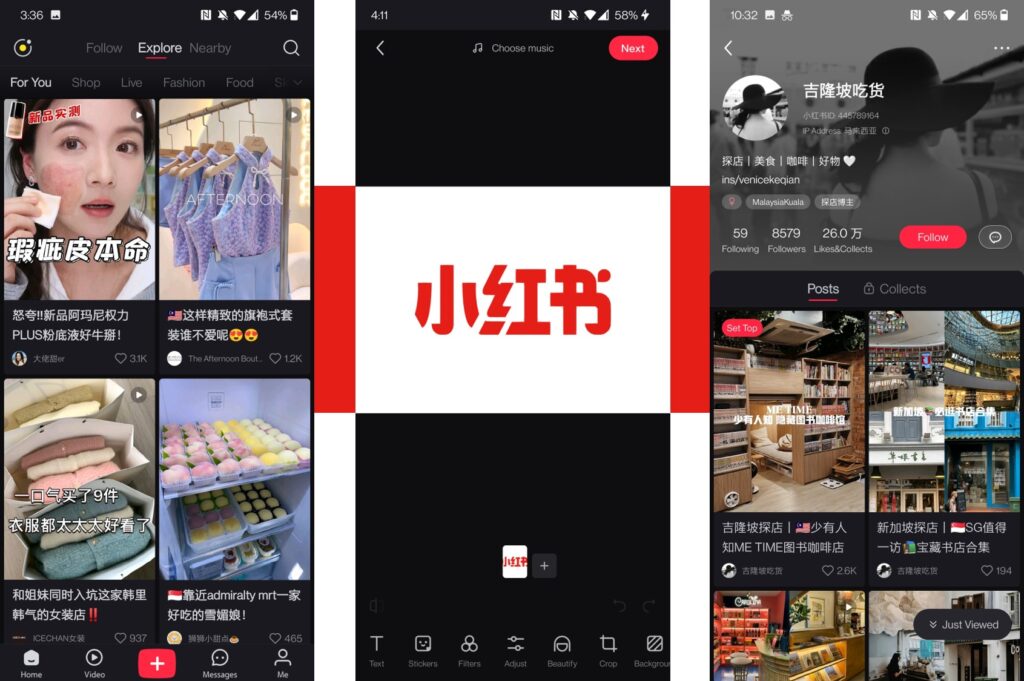

Xiaohongshu (RED) is one of China’s fastest-growing social commerce platforms, blending user-generated content with e-commerce in a format that feels like a cross between Instagram, Pinterest, and Amazon. With over 300 million monthly active users, many of them Gen Z, the platform plays a key role in shaping how younger consumers in China and across Asia discover, evaluate, and discuss products.

By late 2024, Xiaohongshu began actively responding to the deinfluencing shift. It introduced updated community guidelines that encouraged disclosure and discouraged over-promotion. In turn, Gen Z users started creating content around what they call “value transparency” focusing less on hauls and more on why something deserves attention. The most engaged posts aren’t unboxings anymore. They are critiques of ingredients, ethical sourcing, and brand behavior. Trust is built in the details.

In Thailand, beauty creators have embraced what they call “re-influencing”: content that focuses on repurposing and remixing what you already own. One creator, @nath_makeup, created a series comparing big-brand products with local alternatives—not to tear one down, but to contextualize choices. Her audience engaged because the content was useful, self-aware, and locally relevant. It helped people feel informed, not sold to.

Global brands are also adapting. In 2025, Rare Beauty expanded into Southeast Asia without traditional influencers. Instead, they partnered with micro-creators, dermatologists, and mental health advocates who connected the brand to deeper narratives around self-worth and care. The result was high organic engagement because it felt aligned to local consumer.

In this landscape, influence isn’t about reach. It’s about resonance. Brands that succeed won’t just choose creators carefully, they’ll build with communities who see through curated performances and value authentic participation.

Deinfluencing began as pushback against overconsumption, hype, and influencer fatigue. In 2025, it has evolved into a more intentional shift in who consumers trust, how they make decisions, and what they expect from brands, especially in Asia.